Due to the recent Banking Royal Commission, borrowing money is becoming increasingly difficult. It has caused banks to tighten their lending policies which means loans are being assessed more stringently and a critical evaluation of 3 to 6 months of bank statements are being requested, which could ultimately lower your borrowing capacity. It’s now up to mortgage brokers to prove … Read More

Spotlight on Super: Strategies for business owners

With business expenses piling up around you, it’s easy to leave your own super contributions last on the list. While it’s law for you to pay the 9.5% of salary, superannuation guarantee for your employees, many small business owners fail to contribute the same amount (if any) to their own. New financial year. New Super strategy. According to the Association … Read More

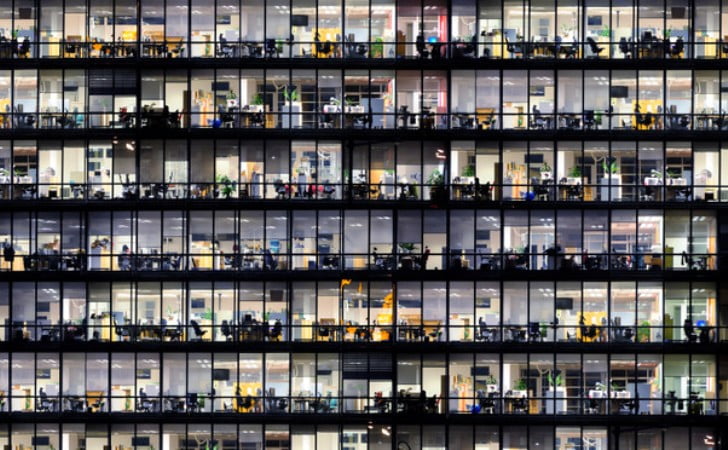

Premise dilemma: how to overcome spatial growing pains

When your business grows, it’s a great thing. But your business can grow rapidly and without adequate planning, there may not be enough space to work efficiently. There are several things to consider when deciding to expand premises, including whether to buy or to lease new premises. The options Leasing commercial premises Leasing commercial premises does not require the … Read More

Two letters, three numbers: What RG146 really means for you

Sounds like a bunch of boring numbers, but as of July 2016 by law anyone giving financial product advice under an Australian Financial Services Licence (AFSL) must satisfy ASIC’s training standards which are explained in Regulatory Guide 146 Licensing: Training of financial product advisers (RG146). The low down There are two set requirements that must be met to provide … Read More

On The Record: Staying on top of small business accounting

Staying focused on accounting is hard for any business owner. If you don’t manage your small business accounting accurately, you can endanger the success of your business. Our 5 accounting tips to help grow your business. Professional vs. DIY Though many business owners act as head of accounting, sales, and marketing to cut cost, it helps to hire … Read More

Why having too much cash isn’t always a good thing

“Too much cash isn’t always a good thing”. It sounds impossible. Improbable. Incomprehensible. Especially for an accountant to say. Businesses love cash, but is there such a thing as having too much? While it may seem counterintuitive to ‘suffer’ from having cash, the risks can be overlooked, offsetting the benefit of accumulating it in the first place. Why cash isn’t … Read More