One in two Australian’s will need to claim for critical illness during their working life, but many don’t have the right insurances in place to cover both their business and their family. Income and life protection are much more than a cheap policy put in place for emergencies. They can protect against losing your home and business in the … Read More

Out with the old, in with the new; How to determine your marketing budget

How much should I spend on marketing? And how much should I expect to get back in return? It’s challenging to attribute one single activity to one sale and as content marketing and social media become large players in the marketing space, it’s getting even harder to say what one single blog post or Facebook post contributed to your daily … Read More

Start the New Financial Year the 542 way

A new Financial Year means a fresh start! So, if you haven’t got your business processes in order, now’s the time to get organised so your 2019/20 financial year is smooth sailing. Mark your calendar First things first, get your calendar in order. If you’re not sure of important due dates for this Financial Year, don’t worry – we’ve done … Read More

When accountants and mortgage brokers collaborate

Due to the recent Banking Royal Commission, borrowing money is becoming increasingly difficult. It has caused banks to tighten their lending policies which means loans are being assessed more stringently and a critical evaluation of 3 to 6 months of bank statements are being requested, which could ultimately lower your borrowing capacity. It’s now up to mortgage brokers to prove … Read More

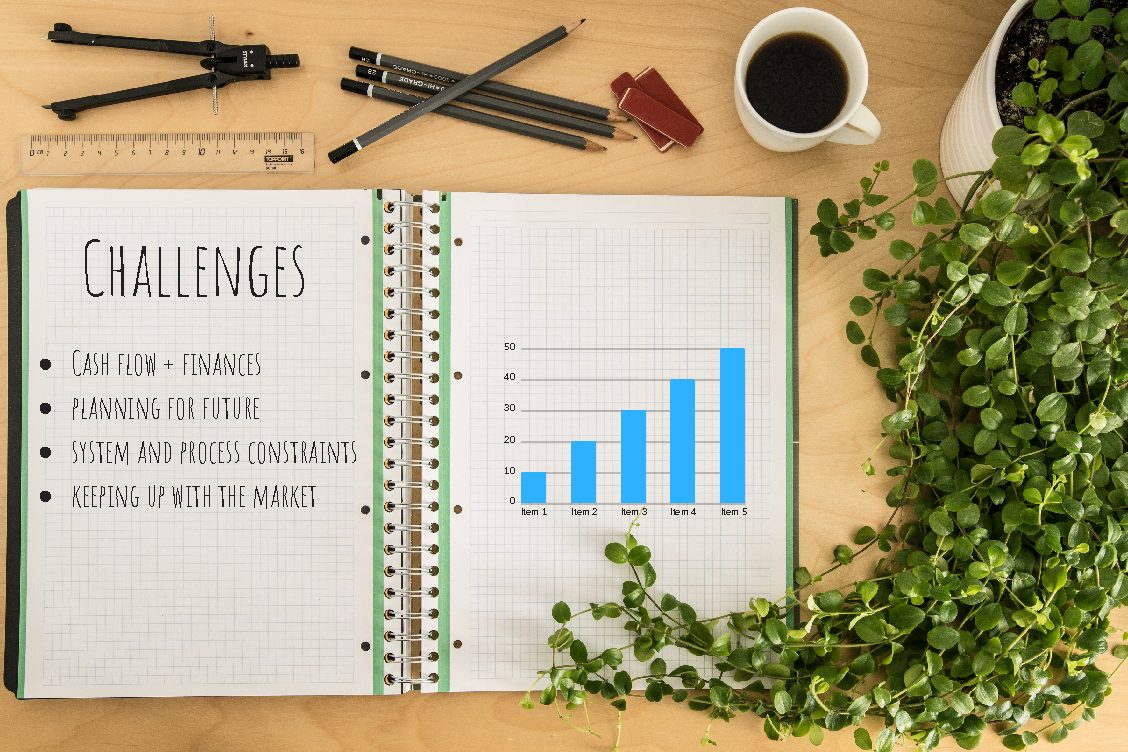

Overcoming business growing pains

The growth stage of every business, while exciting, comes with challenges. When revenue increases and more customers are putting trust in your product or service, common growing pains start to arise that businesses must tackle. Cash flow and financial management Increased revenue doesn’t necessarily mean good cash flow. Managing a higher stream of cash flow is often challenging for … Read More

The banking royal commission: What this means for mortgage broking and how it affects you

At 542 Partners, we pride ourselves on providing a holistic service offering. We use our networks to ensure our clients are delivered the very best accounting service, partnered with other services related to their business needs, such as finance. We’ve worked closely with mortgage broker, Craig Tracey from Craig Tracey Lending, for a few years now. An expert and passionate broker, who’s helped many … Read More

Wrapping up the year that was

And just like that, it’s time to look back at some of the significant legislative and policy changes that occurred this year. $20,000 instant asset write off extended The ATO extended the immediate deductibility threshold for small business until July 2019. The popular announcement is valid for small businesses with a turnover of less than $10 million. Single Touch Payroll … Read More

Buying a business? How due diligence can save you from potential disaster

Buying a business without conducting the right due diligence checks can mean buying a business with a chequered past. Before you ready yourself for ruling a business empire, assemble a team of experts to help you see the woods for the trees. We know it’s exciting, but it pays to consider some key questions before you get wrapped up in … Read More

Is your business ready for EOFY?

While most people would assume we’re pedal to the metal for tax time, it’s pretty much business as usual. We’ve been discussing tax planning with our clients over the past 12 months. Sure, we’ll give them a gentle reminder to pay super contributions before 30 June, including any additional super contributions for the year, but really, it’s just like any … Read More

2018/19 Budget changes that may affect your business.

Reward for work is a dominant theme in this year’s Budget. The seven year personal income tax plan initially targets low to middle income earners before making significant changes to the tax brackets. While there’s much to be said about the complete budget, we’ve reviewed the key highlights that may affect your business. $20k accelerated depreciation extended until 30 June … Read More