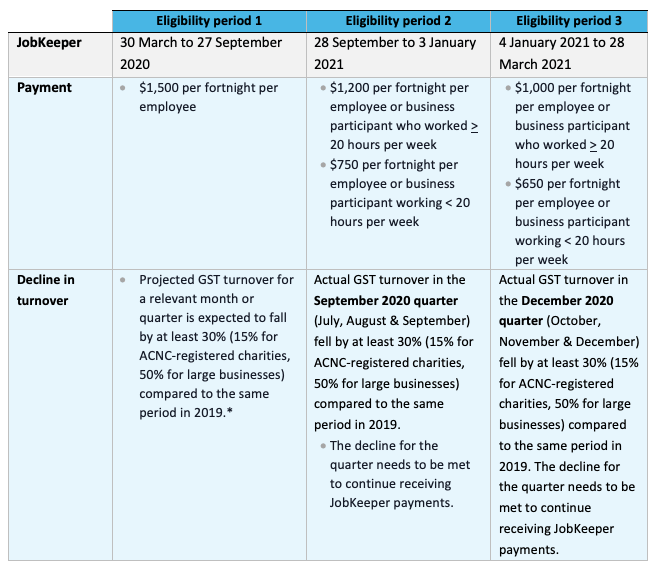

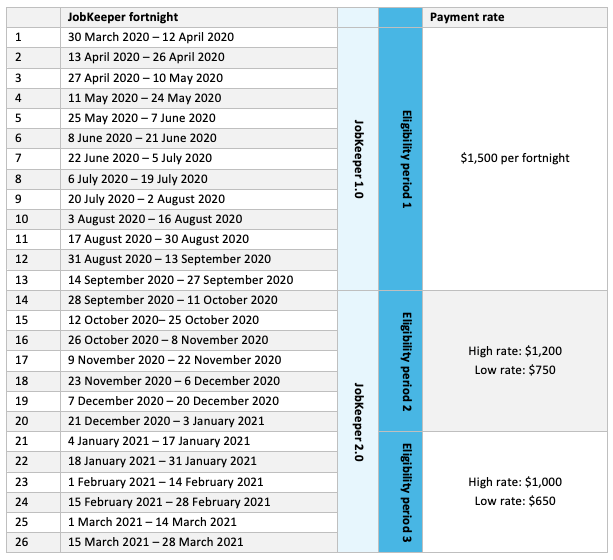

From 28 September 2020, employers seeking to claim JobKeeper payments will need to reassess their eligibility and prove an actual decline in turnover. From this date, the JobKeeper payment rate will reduce and split into a higher and lower rate based on the number of hours the employee worked in the 4 weeks prior to 1 March 2020 or 1 July 2020.

To receive JobKeeper from 28 September 2020, employers will need to reassess their eligibility with reference to actual GST turnover for the September 2020 quarter (for JobKeeper payments between 28 September to 3 January 2021), and again for December 2020 quarter (for payments between 4 January 2021 to 28 March 2021).

Employees that previously failed the JobKeeper eligibility test as they were not employed on 1 March 2020, may now be eligible for payments from 3 August 2020 if they were employed on 1 July 2020.

To access JobKeeper payments from 28 September 2020, there are two questions that

need to be assessed:

Is my business eligible? And

What JobKeeper rate applies to my eligible employees?

We’ve summarised the key information for employers on JobKeeper 2.0 in this update, but remember that the proposed changes are not yet law and the details could still change.

Click here to read the full release on JobKeeper 2.0.

Let us know if we can assist you in any way,

Adam, Craig, Stu and the team at 542 Partners.