If you missed the recent announcement of the 2019/20 federal budget, 542 Partners has you covered!

The ‘Ballot Box’ budget is designed to showcase the return to surplus and engage voters with initiatives to make them feel like they are more prosperous. A massive infrastructure spend adds to this sentiment.

We partnered with Chris Fallico from ACADIA wealth advice to bring you the key highlights from this year’s budget.

The budget in summary:

· Forecast surplus of $7.1 Billion (0.4% of GDP)

· $2.8 Billion extra infrastructure spending

· $19.5 Billion package of personal income tax cuts

· $650 Million allocated to implement the recommendations from the Royal Commission

· Small business instant asset write-off increasing to $30K and expanding to businesses under $50 Million.

Elaboration on each section of the budget is detailed below.

Superannuation

There were minimal changes made to superannuation, however there are a few key points that should be noted.

· New allowances for people to make voluntary contributions later in life (65-66) without meeting the work test, starting 1 July 2020. The current law requires people aged 65+ to meet a work test in order to make contributions.

· Seniors aged 74+ will be able to receive spouse contributions.

Personal Tax

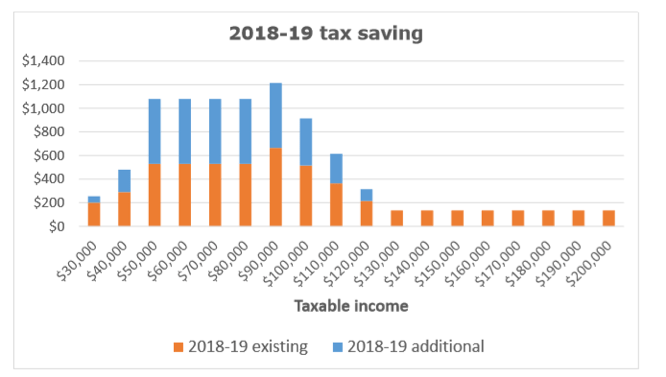

Some of the most significant changes occurred in the personal tax section, with $19.5 Billion package of personal income tax cuts. This means:

· Extending the low to middle income tax offset by increasing the base amount from $200 to $255p.a and the maximum amount from $530 to $1, 080p.a.

· $48, 000 – $90, 000 income earners will be eligible to receive the maximum offset of $1, 080, with the offset phasing out at incomes $126, 000+.

· From 1 July 2024/25, the 32.5% marginal tax rate will be reduced to 30%.

· In the 2024/25 period, 37%of the marginal tax bracket will be abolished under previously legislated changes.

Source: Colonial First State Firstech Federal Budget Briefing 2019

The graph displays the existing legislated tax savings, alongside the proposed additional tax savings.

Business

Changes to the instant asset tax write-off increased from $25K to $30K and made available for medium sized businesses (with an annual aggregated turnover of $10mil – $50mil). The instant write-off will apply from budget night until 30 June 2020.

Social Security

The government will provide a one-off payment of $75 for singles and $125 per couple who receive a qualifying payment on 2 April 2019. This is to provide relief from high energy costs.

Aged Care

The government will be providing $724.8 Million over the next five years, from 2018/19 to fund improvements in residential and home care services which includes:

· One-off increase to basic subsidy for residential aged care recipients from 2018-19 and 13, 500 additional residential aged places.

· 10, 000 additional home packages from 2018-19. Home care packages to be provided across the four package levels, to assist older people living independently in their own home.

· An increase to dementia and the veterans’ home care supplements.

· Additional funding to strengthen aged care regulations.

If you have any questions or want to discuss the budget changes,

Download the full budget here.

Love the blog?

Subscribe to receive it fortnightly.

What do you think?

We would love to hear your thoughts!

Feel free to submit your comments below or comment on our Facebook page or Twitter.

About Acadia Wealth Advice:

Acadia Wealth Advice is a boutique financial advisory firm that specialises in providing advice to high net wealth individuals, busy professionals and business owners.

We help people translate their business success into personal financial results.

Learn more about we can do for you here.

Please note that this is general advice only and should not be taken as advice specific to your circumstances. You should consider whether the information is appropriate for your needs and where appropriate, we recommend you seek professional advice.