As we round out another year, we’re excited by what 2017 holds for business. There’s change in the air and it only means good things for you.

Looking back at the year that was, there are 5 significant changes that occurred this year that will shape 2017 and beyond for you.

Small business and company tax breaks

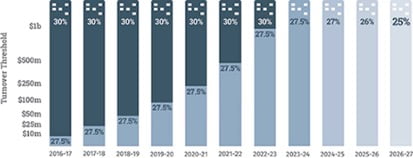

The Government announced in the May budget, its intent to back small business by reducing their tax rate to 27.5% starting with businesses that turnover less than $10 million per year as on 1 July 2016. This will deliver a lower tax for around 870,000 companies in Australia.

Over the next ten years the government intends to lower the tax rate to 25% to encourage investment and higher paid jobs. The overall incentive is to make Australian companies a stronger competitor on the international market. Subsequently living standards among Australian’s should also increase, along with a 1% increase in economic size over the longer-term period.

Superannuation changes

Initially this year the changes outlined were significant, however they have been softened. Recently, the Government announced they will impose a $1.6 million cap on the amount of tax-free super savings a person can hold in retirement from July next year. They have also capped after tax contributions at $100,000 per year, down from the current $180,000. These reforms represent a significant change to protect the flexibility and ensure the sustainability of superannuation.

Download a more detailed outline of these changes here.

Abolition of stamp duty on NSW business assets

Based on the new law the following types of property cease to be dutiable property and as a result duty is not payable on the below type of property on any transactions entered into on or after 1 July 2016.

- A business asset

- Intellectual property that has been used or exploited in NSW

- A statutory license or permission under a Commonwealth law if the rights under the license or permission have been exercised in NSW

- A statutory license or permission under a NSW law e.g. a tax license or water access license

- A gaming machine entitlement within the meaning of the Gaming Machines Act 2001.

As a result, this is ideal for clients looking at buying a business or undergoing internal restructures on already owned business as it has significantly reduced the amount and number of duty to be paid.

Clients will now only be required to pay duty on business assets that include:

- Land and an interest in land (including a leasehold interest and fixtures)

- Goods in NSW, (subject to exclusions, such as stock-in-trade) if the subject of the arrangement includes a dutiable transaction over other dutiable property, such as land.

Exciting announcements out of XeroCon 2016

Overall, Xero in 2016 and beyond is moving towards a more automated and intuitive platform. And by the sound of the below updates, we think its safe to say that Xero are continuing to remove redundant manual and administrative processes to make doing better business a breeze.

Check out the seven announcements that got us most excited here.

The growth of 542 Partners

542 have continued to expand our team and we’ve added two more super stars to the team in 2016.

Rhys and Kurtis joined and have expanded our team approach even more.

When you’re a 542 client, you don’t just get one accountant, you engage a whole team. At minimum, a senior partner and one accountant: a team dedicated to your success. And what’s more their own teams support those senior partners and accountants, creating a whole “we”, working for you and your business.

Want to start 2017 the right way?

542 offer a suite of smart accounting and business advisory services for your complete businesses journey. Let’s talk.

Love the blog? Subscribe to receive it fortnightly.

What do you think?

We would love to hear your thoughts! Feel free to submit your comments below or comment on our Facebook Page or Twitter.