The Australian Taxation Office (ATO) has implemented a new agent nomination process to enhance security and ensure that only authorised tax agents, BAS agents and payroll service providers can access your accounts and manage your tax affairs effectively. This process now applies to all entities with an ABN, except for sole traders. To simplify this process for you, we’re here … Read More

Client stories: The K.I.S.S Marketing Agency

Darnelle from The K.I.S.S Marketing Agency partnered with 542 six years ago when she began her business journey. “I’ve gained a true partner in my business to direct and guide me throughout my financial business journey. 542 have gone way beyond what I expected of a traditional accountant.” – Darnelle 542 Partners came on board as Darnelle’s first client … Read More

Why accounting and business advisory should be two of the same

For a while now, the general commentary around accounting has been around the rise in data entry automation spelling the death the traditional accounting industry and signalling the new approach to accounting. Significant technological change and a shift in the market has forced accountants to re-structure their service offering in an effort to remain aligned with the needs of their … Read More

Spotlight On: Super Strategies for Business Owners

There is no doubt you have heard a lot about the recent super reforms. With so much being said, we’ve distilled our top strategies to help you stay compliant and take advantage of the new rules. Make voluntary personal contributions The goal posts are changing around both concessional (pre-tax) and non-concessional contributions caps. Lower super caps make it harder … Read More

Spotlight on: Super strategies for employees

As an employee, salary-sacrificing superannuation, by making before-tax super contributions, is a popular strategy for middle-to-high income earners. Salary sacrificed superannuation contributions under an effective salary sacrifice arrangement are not considered to be fringe benefits and can be a tax effective strategy for increasing personal and retirement wealth. The general principle behind salary-sacrificing into super is to increase your superannuation … Read More

Spotlight on Super: Strategies for business owners

With business expenses piling up around you, it’s easy to leave your own super contributions last on the list. While it’s law for you to pay the 9.5% of salary, superannuation guarantee for your employees, many small business owners fail to contribute the same amount (if any) to their own. New financial year. New Super strategy. According to the Association … Read More

Company funds Vs. Personal funds: withdrawing money the right way

Many newly incorporated companies that have previously been sole traders find it difficult to distinguish between company money and personal money. As a company director, you’re entitled to receive some form of income such as a salary. However, unlike a sole trader you can’t simply withdraw money whenever you like and use it for personal expenses. This is in … Read More

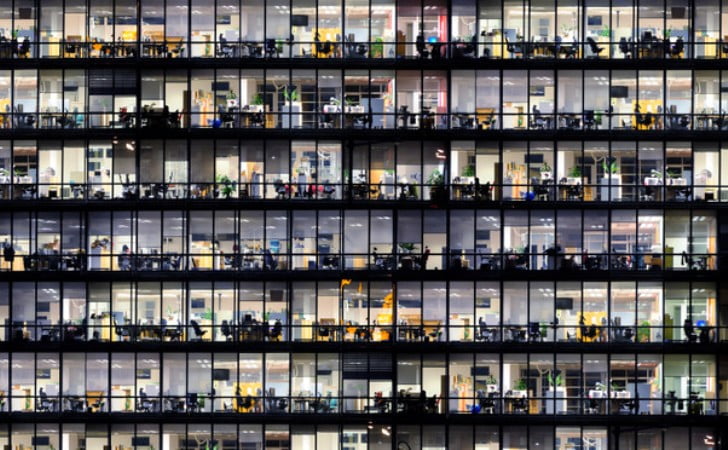

Premise dilemma: how to overcome spatial growing pains

When your business grows, it’s a great thing. But your business can grow rapidly and without adequate planning, there may not be enough space to work efficiently. There are several things to consider when deciding to expand premises, including whether to buy or to lease new premises. The options Leasing commercial premises Leasing commercial premises does not require the … Read More

Two letters, three numbers: What RG146 really means for you

Sounds like a bunch of boring numbers, but as of July 2016 by law anyone giving financial product advice under an Australian Financial Services Licence (AFSL) must satisfy ASIC’s training standards which are explained in Regulatory Guide 146 Licensing: Training of financial product advisers (RG146). The low down There are two set requirements that must be met to provide … Read More

The love issue: why 542 partners make great… partners

As Valentines Day is just around the corner, we’re feeling the love and keen to share it. Are you looking for a new accountant? A true partner in your business? It could be time to shift the dead weight holding you back and assess your relationship with your accountant. Why 542 partners make great… partners We might be … Read More

- Page 1 of 2

- 1

- 2